Renters Insurance in and around Norfolk

Your renters insurance search is over, Norfolk

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's an apartment or a townhome, protection for your personal belongings is a wise idea, especially if you could not afford to replace lost or damaged possessions.

Your renters insurance search is over, Norfolk

Your belongings say p-lease and thank you to renters insurance

Open The Door To Renters Insurance With State Farm

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a condo or townhome, you still own plenty of property and personal items—such as a guitar, stereo, smartphone, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why buy your renters insurance from Brian Topping? You need an agent who is passionate about helping you examine your needs and choose the right policy. With efficiency and dedication, Brian Topping is committed to helping you protect yourself from the unexpected.

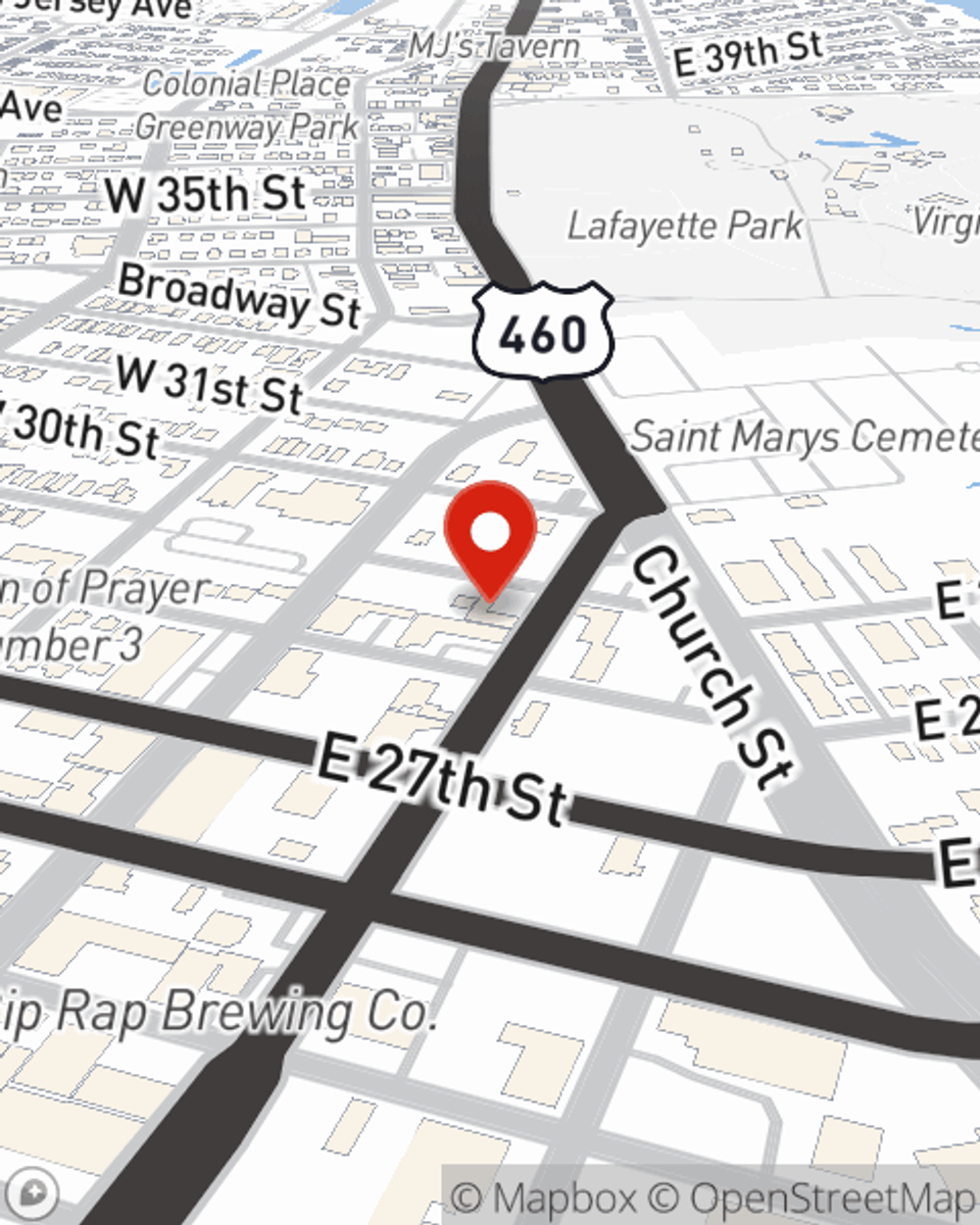

Don’t let fears about protecting your personal belongings stress you out! Visit State Farm Agent Brian Topping today, and see how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Brian at (757) 855-8022 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Brian Topping

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.